Budget with envelopes, spend with confidence

Stop reacting to overspending. Spense helps you allocate every dollar before you spend it, just like envelope budgeting but designed for modern life.

Free to download

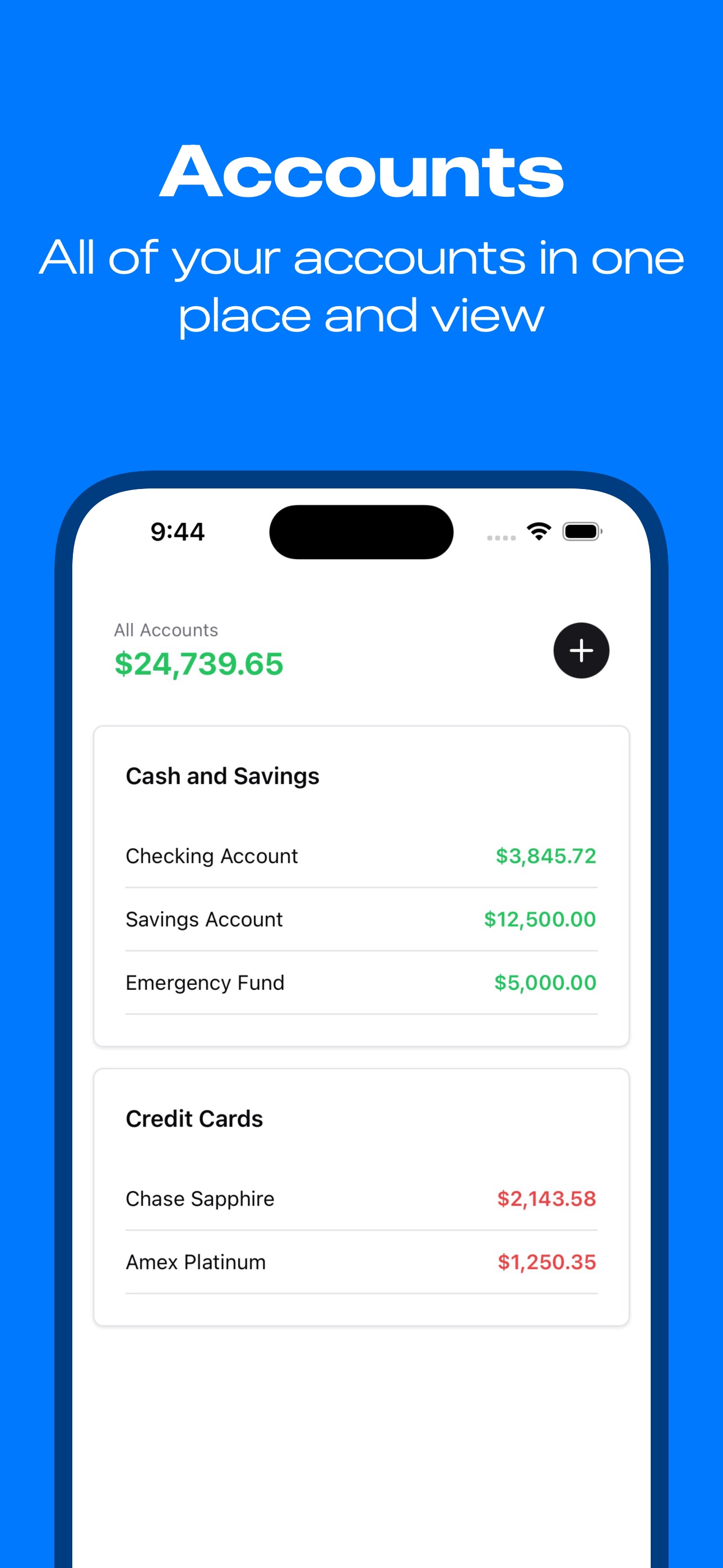

Accounts

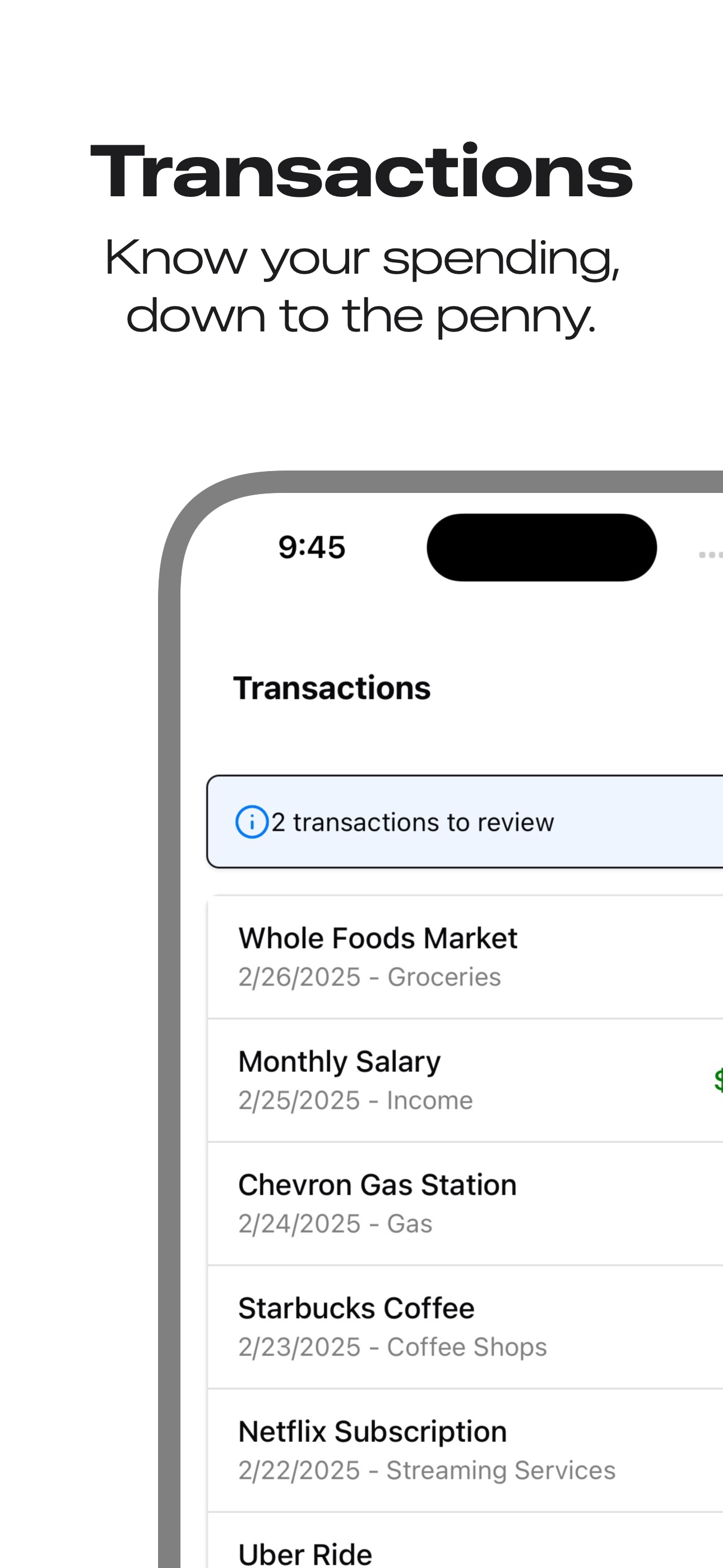

Transactions

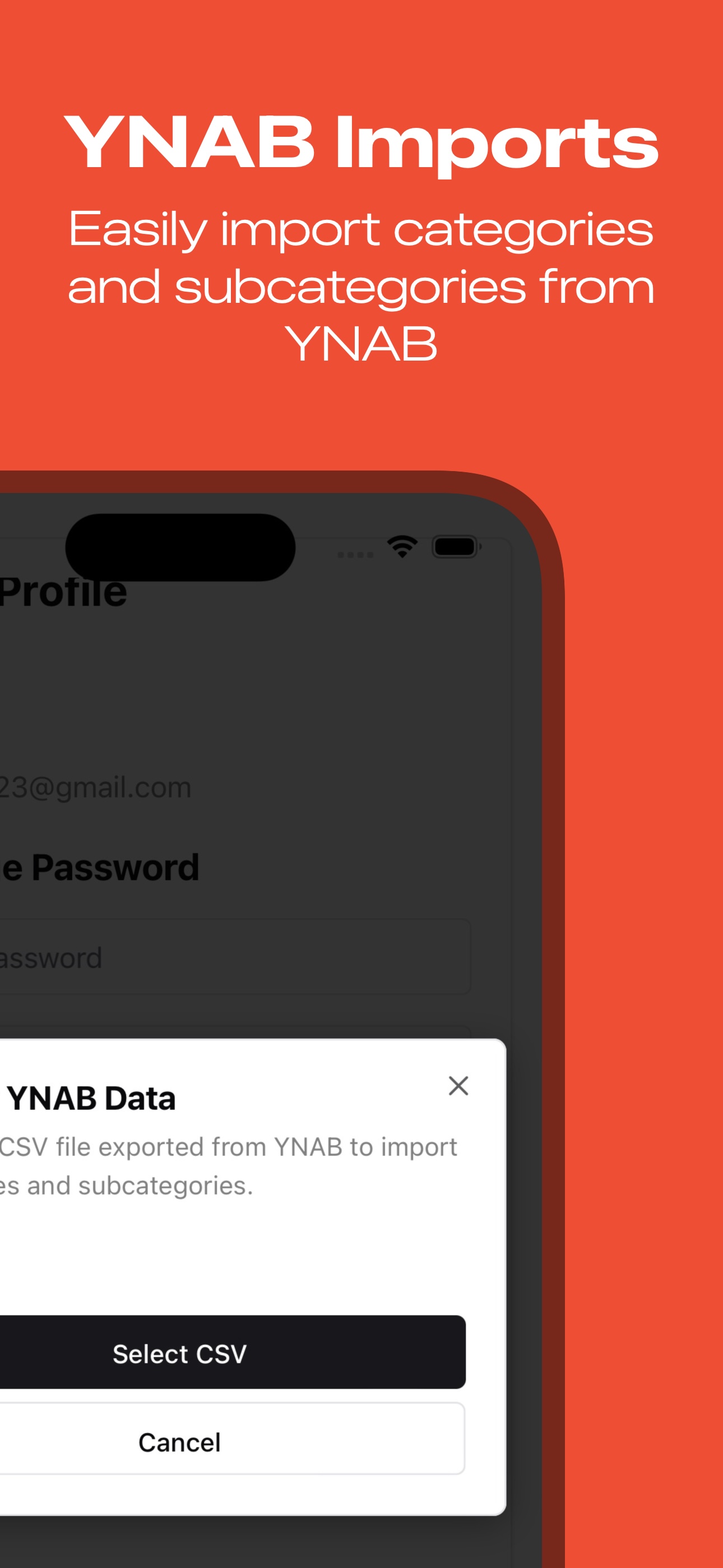

YNAB Import

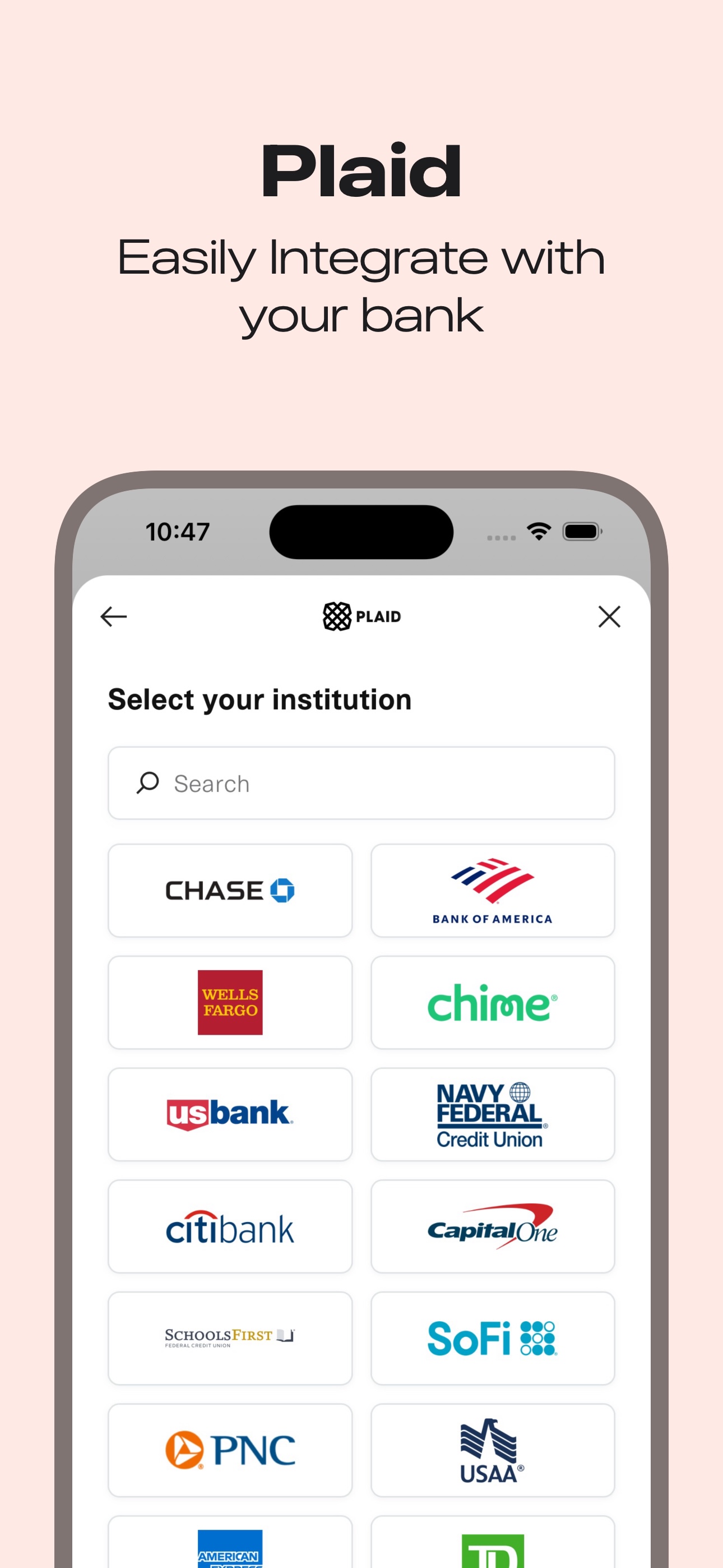

Bank Integration

Trusted by thousands of proactive budgeters

How it works

Proactive budgeting in three simple steps

Allocate before you spend, track as you go, adjust when needed.

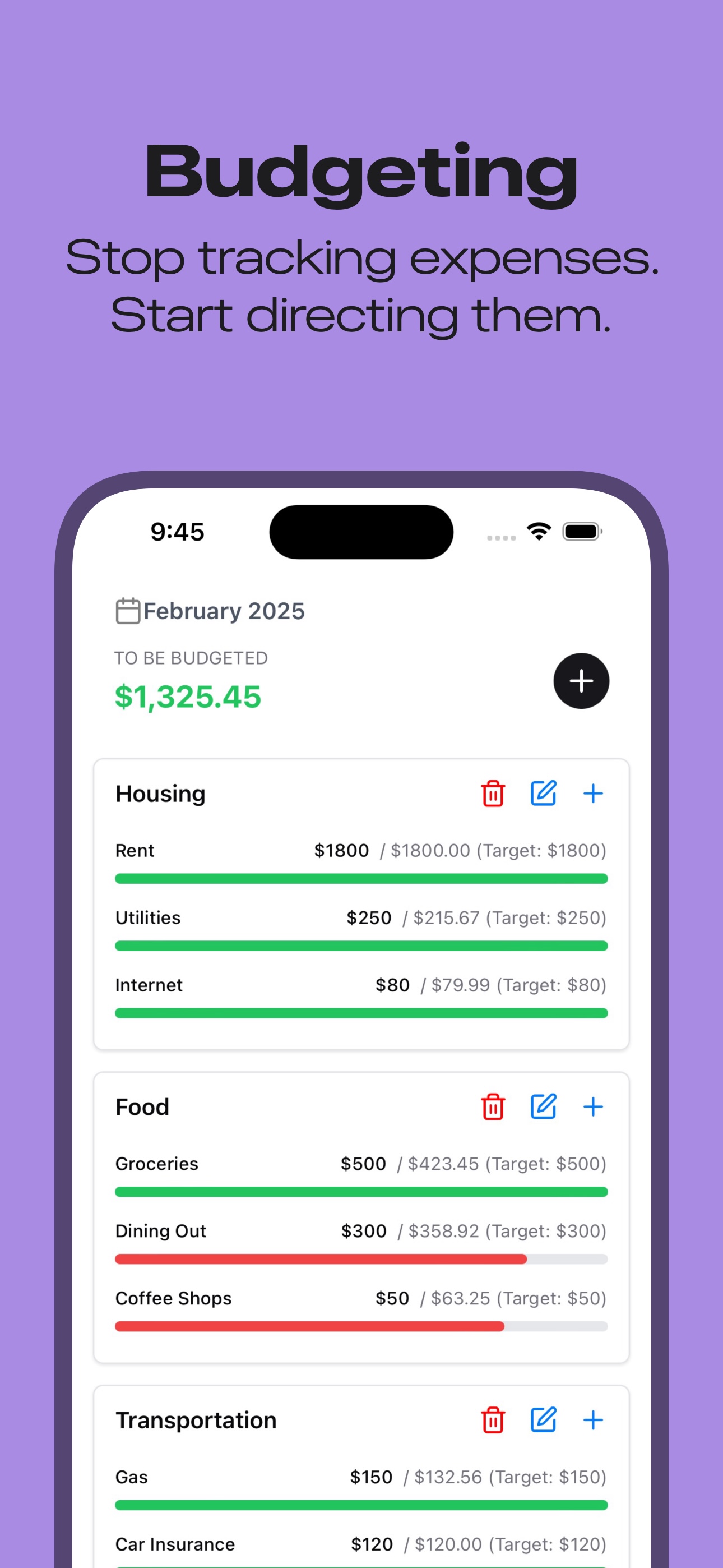

Create your envelopes

Set up budget categories like groceries, dining, and entertainment. Allocate money to each envelope based on your income.

Spend with confidence

Transactions automatically sync via Plaid and deduct from the right envelope. Always know how much you have left to spend.

Stay on track

Get to know when you're close to envelope limits. Move adjusts for vacations and big trips monthly.

Why envelope budgeting works

Be proactive with your money, not reactive

Traditional budgeting tracks where your money went. Envelope budgeting decides where it goes.

Every dollar has a purpose

Before you spend anything, you decide what each dollar is for. No more wondering where your money went at the end of the month.

Prevent overspending

The best way to fix overspending is fixing your habits and knowing where every dollar goes. Plan for a big vacation monthly and know how much you have.

Bank-level security built in

Your financial data deserves the highest protection

Face ID & Touch ID

Secure app access with biometric authentication. Your budget stays private even if your phone doesn't.

Plaid Integration

Connect your bank accounts securely through Plaid's encrypted, read-only access. We never store your banking credentials.

256-bit Encryption

All data is encrypted in transit and at rest using the same standards as major banks and financial institutions.

Proactive vs. Reactive budgeting

See the difference envelope budgeting makes

Traditional Budgeting (Reactive)

- Track spending after it happens

- Often overspend in categories

- Wonder where money went

- Feel guilty about purchases

Envelope Budgeting (Proactive)

- Decide spending before it happens

- Prevent overspending automatically

- Know exactly where money goes

- Spend with confidence and purpose

What users are saying

Real people, real results with envelope budgeting

"Finally, a budgeting app that stops me from overspending instead of just telling me about it afterward. The envelope method just clicks!"

"I've tried every budgeting app out there. Spense is the first one that actually changed my spending behavior. Love the Face ID security too."

"The Plaid integration makes everything automatic, but I still feel in control of every dollar. It's like having a financial advisor in my pocket."

Start budgeting proactively today

Join those who've taken control of their finances with envelope budgeting. Every dollar gets a purpose, every purchase has intention.

Free to download